The Italian group with 18 shipyards worldwide and projects spanning from civil to military in the maritime domain has presented its 2026-2030 business plan called F4 – Fast Forward Further Future, as a further step forward in the company’s growth path, underscoring the strength of the strategic vision implemented in the past three years, combined with an increase in production capacity to address strong demand macro trends, in particular in the defence segment, and further expansion in the underwater one, through internal developments and potential selective inorganic growth opportunities, in addition to the civilian shipbuilding segments development

“Building on the record total backlog of approximately 60 billion Euro already secured (with deliveries up to 2036), providing long-term visibility, we expect over 50 billion Euro in new orders over the period, revenues growing at an average annual rate of 8% and net profit at approximately 500 million Euro in 2030, driven by an increase of 40% in revenues and 90% in EBITDA compared to 2025.

All of this is underpinned by an increasingly solid financial structure and strong cash generation, suitable both to fully fund the investments aimed at increasing the production capacity and to pursue the financial discipline and deleveraging objectives,” Pierroberto Folgiero, CEO and Managing Director of Fincantieri, summarized in the press statement released aside the presentation to investors, analysts and media gathered in Milan.

The 2026-2030 business plan is centred on four strategic pillars: increase in production capacity or ‘capacity boost’, productivity increase, strengthening of ongoing strategic projects and growth in adjacencies.

In the current and foreseen geopolitical scenarios, the naval defence business, “characterized by high margins and a strongly positive impact on the Group’s working capital profile,” registers significant growth opportunities in Italy, Europe, and other strategic regions, including South-East Asia and Middle East. In the near term, demand is also expected to be supported by funding made available under the European Union Security Action for Europe (SAFE) facility providing up to 150 billion Euro in loans. SAFE requires orders to be filed in 2026 and deliveries within 2030.

“The defence segment plays a central role in our strategy: the expected increase in demand, together with the doubling of production capacity across our Italian shipyards, will enable us to further strengthen our positioning within the major national and international programmes,” Fincantieri CEO & MD said.

To cope with this fast-developing market, Fincantieri is doubling the production across Italian shipyards with a consequent worldwide shipyards system reconfiguration and shifting part of civilian shipbuilding on other sites, supported by an overall self-funded 1,9 billion Euro investment plan.

The production doubling in the defence segment will be achieved through the first of the two-phase “capacity boost” programme, which is focused on shipbuilding process improvements and selected capital investments.

The Castellammare di Stabia shipyard, today working on both civilian and military surface vessels, will be fully devoted to defence production, moving cruises volumes to Romania, according to Claudio Cisilino, EVP Operations, Corporate Strategy & Innovation.

“Riva Trigoso is a shipyard where we build surface vessels for the Italian (and foreign) Navy. We are working today on the production processes and cross-fertilizing best practices from the commercial business, for example pre-outfitting…. We will also have some selective capital investments such as the implementation of a third launching line, so that we will work in parallel on three ships, increasing productivity and increasing capacity,” the Fincantieri representative continued, highlighting activities on the Muggiano shipyard, where surface vessels are outfitted, trialled, and delivered together with the production and delivery of underwater platforms.

“Underwater will grow a lot and therefore we are working on reviewing completely the production process of the submarines, applying automation and other technologies to optimize and reduce overall delivery time,” he outlined, “also leveraging on (integration of) La Spezia Naval Arsenal areas”. Fincantieri will also prepare the shipyard to accommodate a new floating dock that will replace the old one.

All these activities are already underway, according to the Fincantieri representative. “We think we will complete this phase in a very short timeframe, between six and 18 months, meaning that by the end of next year we will have already completed the first phase.” The selected capital investments on worldwide shipyards, including Italy, Romania and the US, where automation and robotics will be introduced to boost efficiency, are concentrated in the second phase of the capacity boost programme.

As an effect of the “capacity boost” programme, Fincantieri representative provided the example of the FREMM platform. “Nowadays, it takes 51 months to build a FREMM … We are fully convinced that through the actions that we have seen before, working on the processes, avoiding the bottlenecks, marking certain investments, we will reduce this time by 18 months,” Cisilino outlined, this allowing Fincantieri to increase the FREMM production rate. Answering to EDR On-Line, Fincantieri CEO &MD confirmed that this reduced construction and delivery timeline could be attained with the first phase of the “capacity boost” programme.

Focusing on short-term naval “must-have” opportunities, Folgiero underlined that the company expects orders for around 5 billion Euro in the next six months in the defence segment. “Starting from the Italian Navy, orders are expected for two DDX (or DDG NG) next generation destroyers, alongside the EPC (or Multi-Mission Patrol Corvette, MMPC) Call 2, and the third Vulcano-class logistic support vessel.” Then comes the worldwide export market for frigates, on which we the company does not want to disclose the opportunities. Folgiero also highlighted the surface business, which Fincantieri “has been cultivating since several months in the Middle East.” He also spoke about the US market, where “in the next six months, we will see something very, very concrete.” The company is waiting the first results of the re-prioritization of shipbuilding programmes by the new US Administration, with Fincantieri Marine Group confirmed as a strategic shipyard for future programmes, according to the company. During the event, the development of a dedicated partnership for the unmanned segments with an undisclosed party was also confirmed.

The slide focusing on the naval opportunities and presented during the event, also mentioned that other significant commercial opportunities with medium-high probability in 2026 could come from Italy, North Africa, Middle East, and Southeast Asia with visible growth through options within the plan timeframe. Although no further information was released on the main deals to occur in the next six months, EDR On-Line understood that among export frigates deals, the Portuguese MoD programme for up to three frigates to which Fincantieri has responded with the FREMM EVO design, is the most likely deal to be attained in such a short time due to their procurement with the EU SAFE funding. Moreover, the European Defence Fund (EDF) MMPC Call 2 regards the award for a certified design and production of a platform for each one of the two versions of an innovative, modular, flexible, interoperable, green, multirole vessel for the European navies.

The Fincantieri CEO & MD also stressed the efforts in the development of a naval platform to effectively address the requirements of modern naval doctrine, increasingly centred on the reconfigurable surface vessel and “mother ship” concept for unmanned systems.

Folgiero also highlighted the long-term strategic vision on the nuclear propulsion. “The nuclear is certainly a long shot, but like all great revolutions, you have to start tomorrow,”, he said, as Fincantieri is studying and evaluating the engineering impacts of the alternatives of the nuclear at sea through activities with different partners. Fincantieri is also supporting with other companies the Italian Navy in defining potential technological trajectories for nuclear propulsion under the Minerva project.

The unmanned platforms, either surface or underwater, is another key segment of development for Fincantieri, leveraging on the strategic partnerships with Defcomm and Graal Tech companies to strengthen its technological positioning alongside the Unmanned Management System (UMS) developed by Fincantieri NexTech, and the multi-purpose robotic vessels that Fincantieri’s VARD company already sold on the oil and gas market.

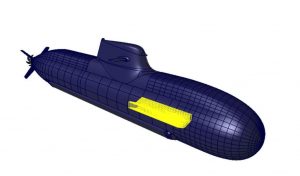

In the underwatersegment, growth is supported by submarines fleet upscaling and upgrading programmes across Europe, the Middle East and Asia, as well as by the evolution of the sector towards an ecosystem encompassing defence, commercial and dual-use applications. Fincantieri is building the new class of U212 NFS AIP with lithium-ion batteries and working on unconventional solutions such as large displacement autonomous unmanned vehicles for the Italian Navy and other foreign customers. The sector evolution is driving increasing demand for solutions in the areas of critical infrastructure protection and threat mitigation, unconventional warfare, and seabed exploration of mineral resources.

The company is also highly active in the commercial underwater domain, particularly in the infrastructure protection and operations management sectors, supported by the recent acquisition of Xtera, the partnership with Wsense, and the company’s distinctive proprietary solutions, including “rock dumping” technology. Further growth is expected from Remazel Engineering and from the core business of WASS Submarine Systems, driven by strong demand for torpedoes and other traditional defence systems. WASS has been instrumental to recently win important deals for heavy-weight and light-weight torpedoes respectively on Indian and Saudi Arabian markets against a strong international competition and is working on new generation underwater weapons and sensors.

The “productivity increase”, the second strategic pillar of the new business plan,will be pursued through three initiatives: operations excellence, supply chain evolution and long-term resource planning. To address the plan requirements, the number of direct employees of Fincantieri will reach 27,500 by 2030.

Photos courtesy Fincantieri and P. Valpolini